Sports fandom falls into two camps - casual and avid fans. Casual fans understand the game and consume content through various live and non-live channels. Avid fans are highly knowledgeable, follow the sport closely, and actively promote and share their love for the game. In a world where sports are the last remaining draw for live content, big tech has stepped in to gain attention-share from both with a big move geared towards the casual fan.

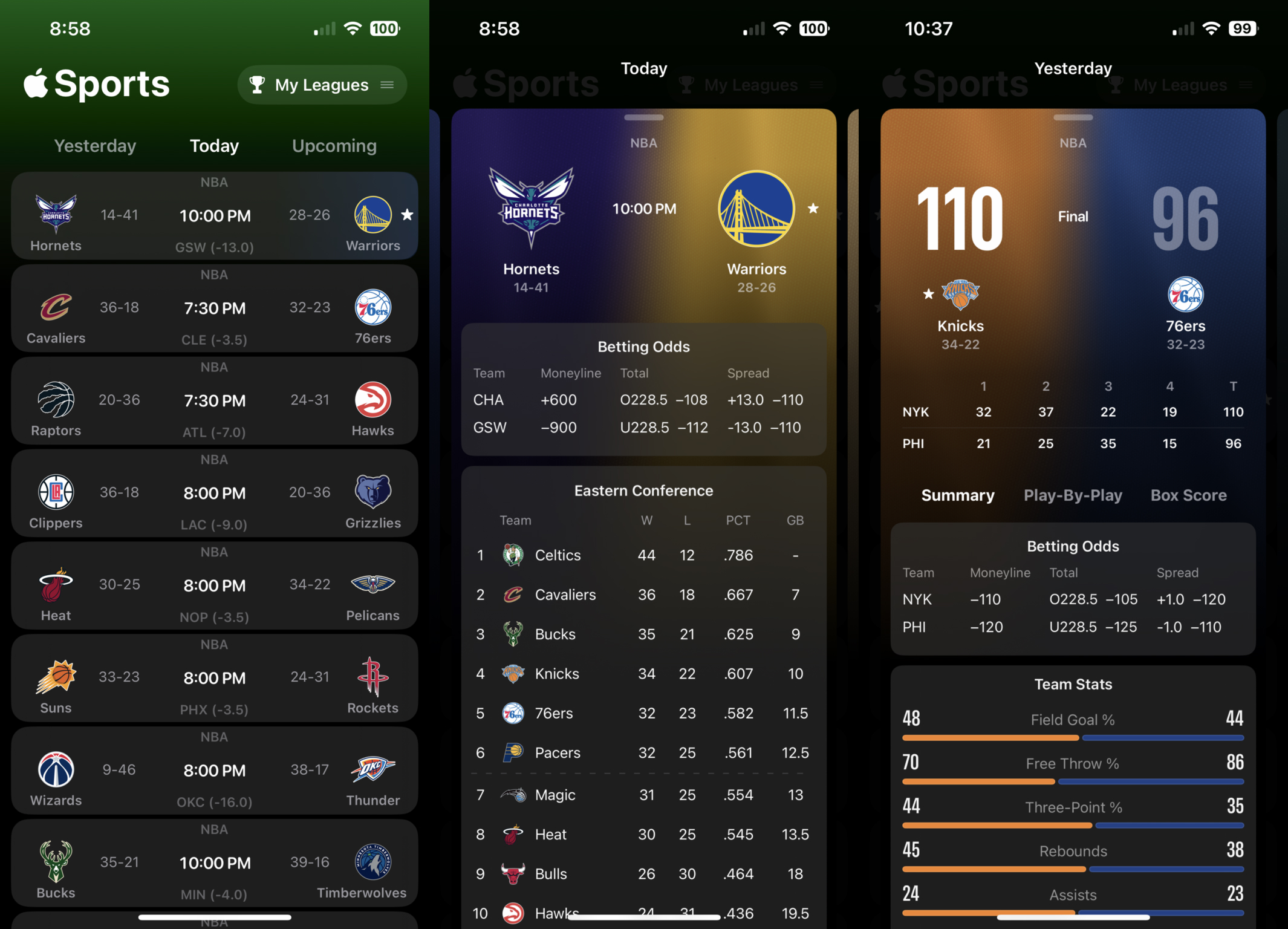

Apple recently launched Apple Sports, a free (and ad-free) app for download in the U.S., the U.K. and Canada, their next investment in the sports ecosystem. The app offers live scores, stats and real-time betting odds, provided by DraftKings, for the major leagues (domestic and international) currently in-season. More sports will be added later this year.

The appeal of the app for casual fans may come from its simple design and ease of navigation. There’s one screen with a toggle between yesterday’s, today’s and upcoming scores, personalized with the leagues and teams a user favorites. "It's very simple to solve a problem that I've had as a sports fan, and I think most people have had as a sports fan, which is how do you get scores and stats for live games?" says Eddy Cue, Apple's Senior Vice President of Services.

As expected, Apple is leveraging this app to drive users to Apple TV subscriptions for the live content rights they’ve invested in, including all MLS matches and select MLB Friday Night Baseball games.

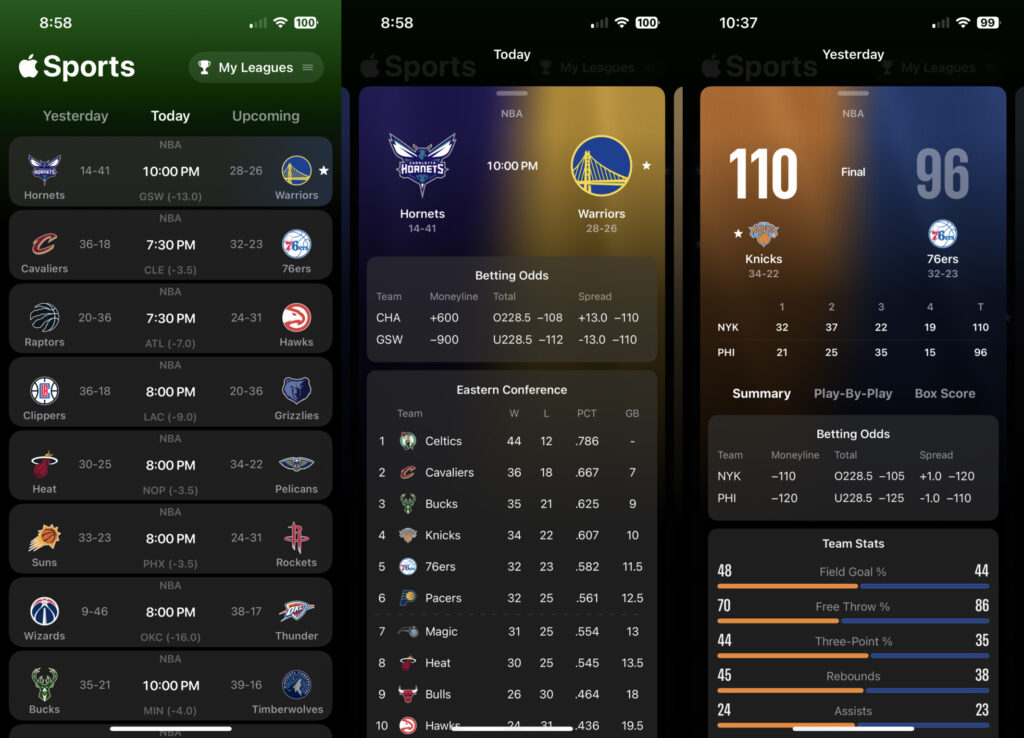

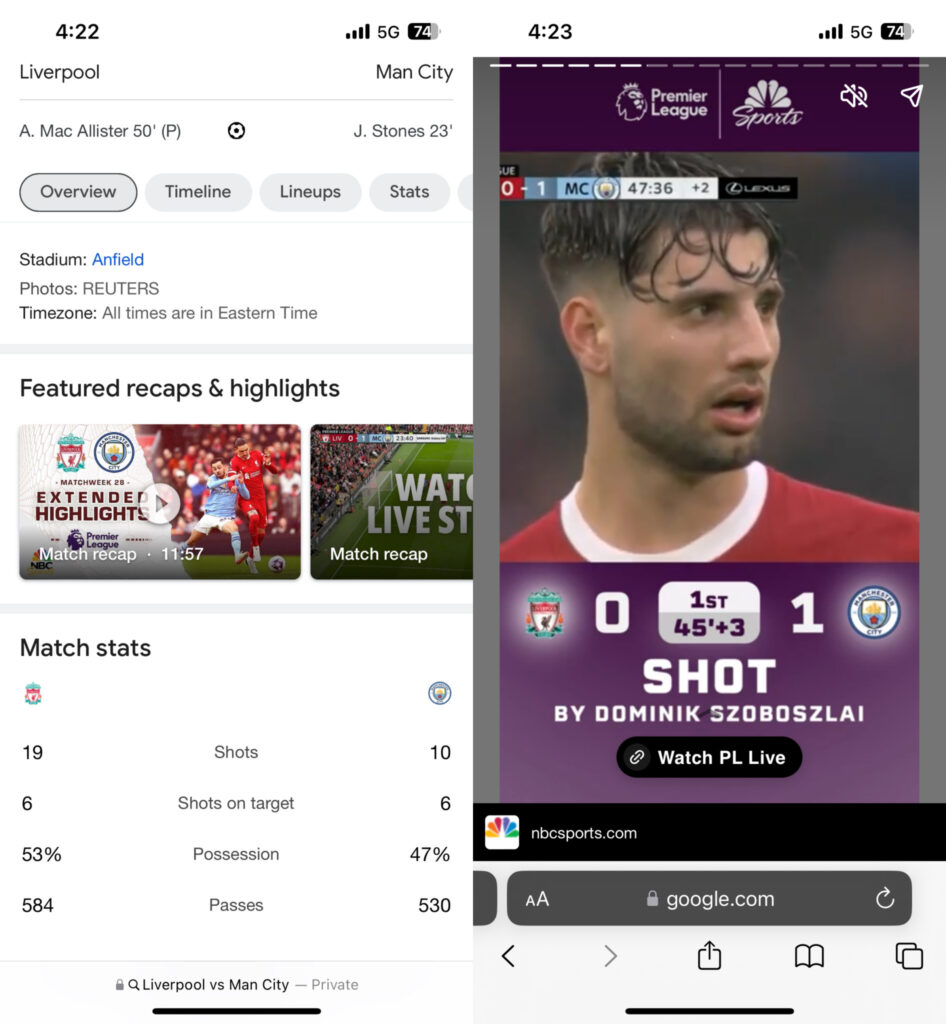

Apple’s move is the latest in a bigger push from technology companies to build out digital experiences for sports. Both Google and Microsoft (Bing) already offer simple, user-friendly displays in their search results any time you look up a major league, event or team. Google’s OneBox sports search experience also drives users to YouTube for full-game recaps and recently added in-game highlights stories.

Each company is seeking to tap into their large audiences as a top-of-funnel driver to revenue. Apple is seeking to drive subscriptions for Apple TV via their broader Apple OS ecosystem, while Google and Bing are leveraging search traffic to monetize through ad revenue (from YouTube highlights, for example).

While Apple Sports is available for download in the App Store today, future iOS updates may include the app on their automatically installed list. Apple has created built-in utility apps like Weather, Stocks, Maps, and Health - sports now likely falls into this standard lifestyle sequence. Apple’s release of Live Activities also comes into play here, as every iPhone user could ultimately view sports updates without even unlocking their device.

The iPhone has a 61.3% market share in the U.S. smartphone industry[1], and Google reported that sports as a search category has seen average search interest of 79 (out of 100) in the U.S. over the last 12 months.[2] For casual fans seeking basic stats, highlights and information on when-to-watch or where-to-watch games, the tech companies that proactively deliver users what they seek have that covered.

So where does this leave sports organizations vying for engagement (and revenue opportunities) on their owned and operated channels?

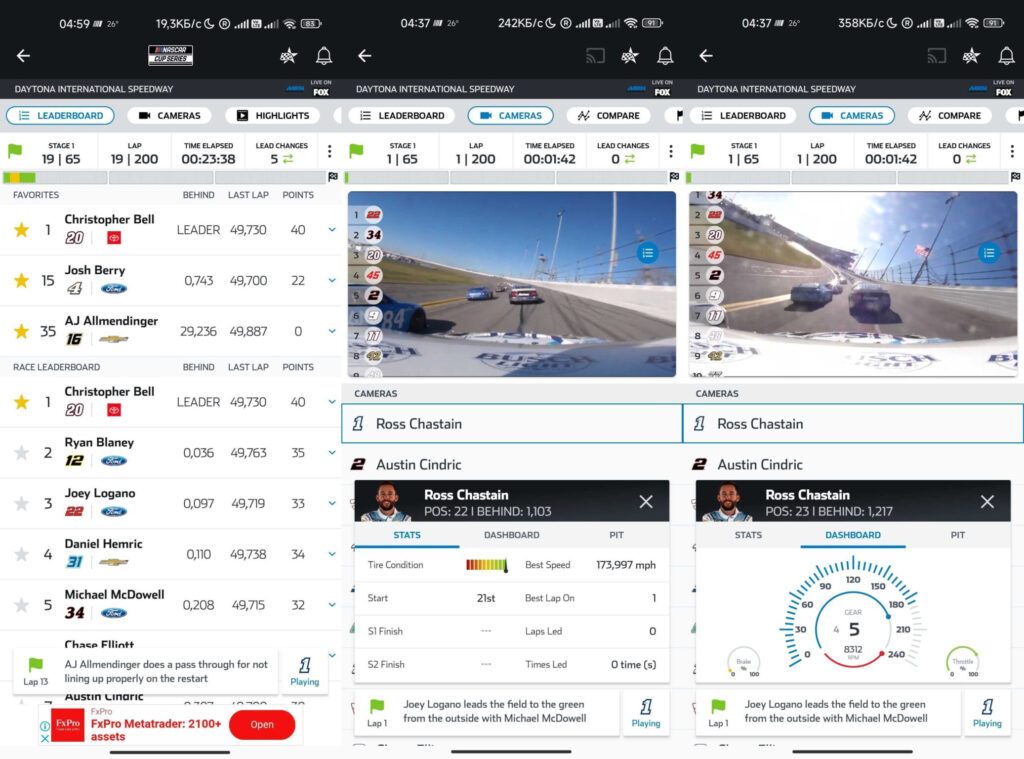

Fans can find a box score and statistics anywhere on the internet. But what you can’t find, and what sports organizations need to capitalize on, are unique assets and analysis fans can only find on their channels.

Experiences like NASCAR’s Race Center offers fans advanced data points from each car like tire condition and fuel level, coupled with Scanner Audio that allows fans to listen in on driver and crew strategy. Last summer the USGA built ShotCast for the U.S. Women’s Open at Pebble Beach, offering fans radar data, shot trails, greens views and video highlights for each player in the field. This was the first women’s golfing event to leverage the PGA Tour’s ShotLink technology. These types of experiences draw in the avid fans seeking to go a level deeper and can encourage casual fans to learn more about the sport.

With a sound data strategy supported by unique experiences, leagues and teams will be able to grow their databases and maintain meaningful 1:1 fan relationships.

What’s Next?

As we counsel our sports partners, ‘what’s next’ in tech is always about incentives. The incentives for tech companies like Apple and Google are about platform adoption, ad revenue and subscription services. The incentives for sports properties are about return on investment; i.e. how much do you have to invest in tech to build a data asset that you can monetize? How do you leverage tech to build a direct relationship with fans?

Google will continue to invest in OneBox and their overall search experience, which could further reduce organic search traffic to sports organizations and publishers. A recent example is the release of Search Generative Experience (SGE) which leverages generative AI to provide snapshot search results to users. According to Search Engine Land, SGE’s potential impact on organic search results to publishers could be anywhere from 20-60%.[3]

Apple’s investment into their sports ecosystem will undoubtedly expand as well. Editorial content, highlights, fantasy gaming and betting will all likely be on the table as Apple explores what’s next. This may start with a more seamless integration of MLS Season Pass and MLB Friday Night Baseball, granting Apple TV subscribers access to highlights and live games in the Apple Sports App.

Apple Sports strategically timed their February 21st launch with the MLS season opener to maximize visibility. Coming up soon is MLB’s Opening Day on March 28th.

The sports business industry will be watching closely to see how the world’s most valuable companies decide where sports fit into their overall strategy of growing, engaging and monetizing their billions of users.